The electrification of transport is leading to massive upheaval, not just in the automotive industry. New technologies are enabling vehicles to become more efficient, which is also making them increasingly cheaper and is giving rise to new potential uses.

The quiet hum in the distance is the sound of a fundamentally changing mobility sector – away from the combustion engine and toward the electric motor. In the coming years, we will see more and more electric vehicles on the roads, seas and in the air.

According to McKinsey, in the last ten years the automotive industry alone has invested more than 400 billion US dollars – around 100 billion US dollars of this since the start of 2020. This money was not only put into developing electric motors, but also into technologies for connectivity and autonomous driving. Overall, these innovations will contribute to reducing the costs for electric vehicles and make their combined, shared-mobility-based use a real alternative to owning a car.

Upheaval in the supply industry

Established automotive suppliers are converting their production process from making components for combustion engines to making components for electric vehicles. According to McKinsey, critical components for electrification, such as batteries and electric motors, as well as LiDAR (Light Detection and Ranging) or radar sensors required for autonomous driving are expected to make up 52 percent of the entire market volume for automotive components by 2030.

More efficient motors

Innovative solutions for purely electric driving include highly integrated electric drivetrain modules, for example. In these, the electric motor, transmission and power electronics are combined into a single unit, making them not only lighter but also more powerful. Here is an example: Continental’s drive module can reach a high power density with up to 150 kilowatts at up to 400 newton metres of electric torque – and all that with a weight of just 75 kilogrammes.

Power electronics with high efficiency

Thanks to advancements in power electronics (inverters, chargers, DC converters), it has been possible to improve drivetrain efficiency, such that either smaller batteries are sufficient or range is increased. In particular silicone carbide MOSFETs and high-voltage platforms with 800 volts or more can help achieve a higher efficiency. The experts at IDTechEx assume that 800-volt platforms and silicone carbide inverters will grow to have a market share of 10 percent by 2030.

Improvements in lithium-ion batteries

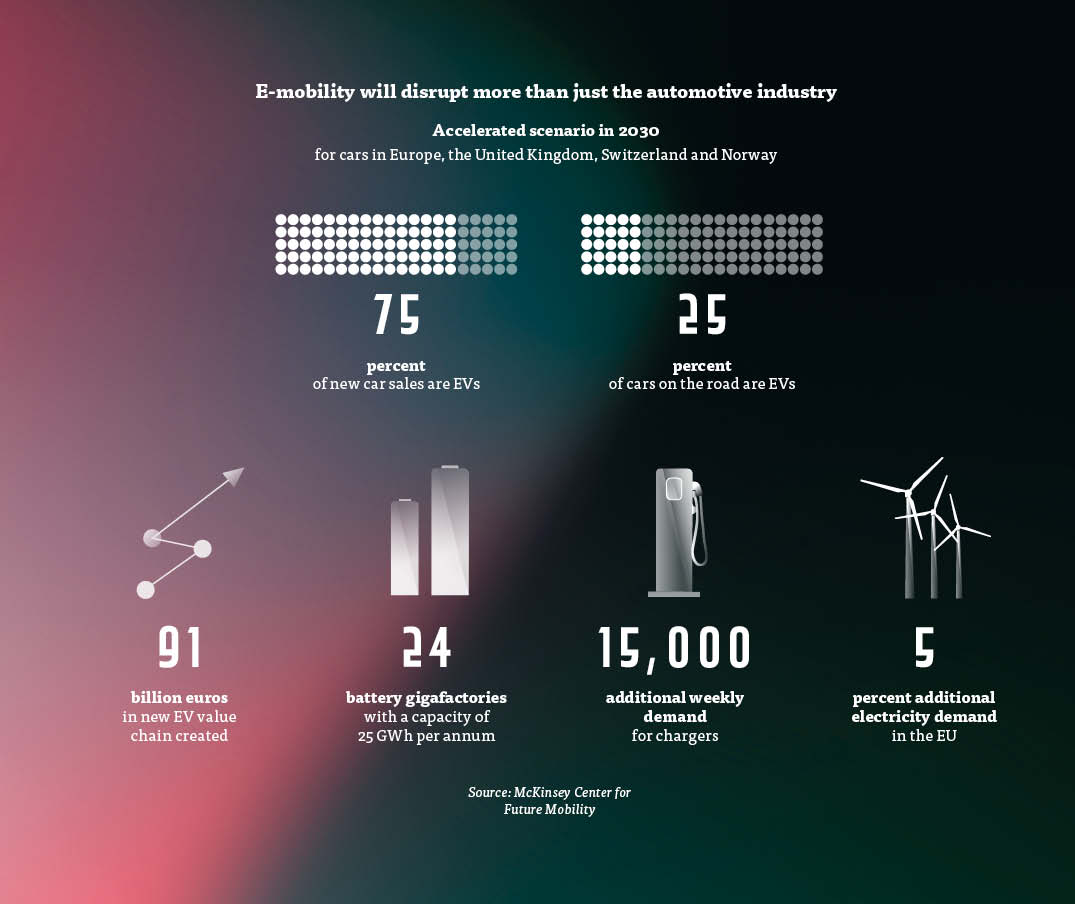

Every electric motor needs energy. To be able to supply the growing electric vehicle market with sufficient power storage devices, battery production capacity in Europe must increase by a factor of 20 to 965 gigawatt hours by 2030, according to McKinsey. That means that Europe needs roughly 24 new battery factories.

Lithium-ion batteries are likely to retain a dominant position here in the future, as alternative energy storage devices for the mobility sector are not yet in sight, at least not before 2030. However, gradual improvements are being achieved with cathodes, anodes, cell design and energy density. For example, Nissan has set itself the goal to keep refining lithium-ion batteries and reduce costs by 65 percent by 2028 with a cobalt-free technology. IDTechEx also assumes that battery cells with up to 400 watt hours per kilogramme will arrive on the mainstream market by 2030.

Charging infrastructure

However, these batteries must also be charged and for this, a huge amount of charging infrastructure must be built. A current study from the ACEA shows that Europe will need up to 6.8 million public charging points by 2030. The charging stations will have to be both easy to operate and provide a high charging output. The market launch of Plug & Charge represents major progress in this respect: the vehicle identifies itself at corresponding charging stations and automatically starts the charging process.

Nowadays, charging stations can reach a charging output of up to 350 kilowatts; the first charging stations with a charging output of one megawatt are now also coming onto the market. However, these types of high-performance charging stations are aimed less at the car segment, but rather at charging trucks – or aircraft and boats in the future. Science and industry are working on a medium-term solution to increase charging output to three megawatts.

The electrification of the mobility sector will inevitably bring about increased electricity consumption: by 2030, electric vehicles in Europe will require on average more than five percent of all electricity produced. Therefore, it will be important to reduce the load on the network during peak load times with “controlled charging”. This means that charging time, duration and intensity will be controlled with the help of Vehicle-to-Grid-Technology (V2G).

A new industry is emerging

The change to e-mobility is taking place at an unprecedented pace, affecting all sorts of different sectors, including energy, infrastructure and automotive. This presents an enormous opportunity for both established and new stakeholders to take on a leading role in creating new billion-dollar industries and new jobs. The key to this is the combination of sustainability and economic viability through innovative technologies.